Common sense: Trump’s contribution to economics

Some economic experts haven’t yet caught up with President Trump’s contribution to economic theory. During the Vice Presidential debate, JD Vance explained that Trump’s economic plans were simply “common sense”:

A lot of… economists attack Donald Trump's plans, and they have PhDs, but they don't have common sense… [T]hose same experts for 40 years said that if we shipped our manufacturing base off to China, we'd get cheaper goods. They lied about that… And for the first time in a generation, Donald Trump had the wisdom and the courage to say… we're bringing American manufacturing back,

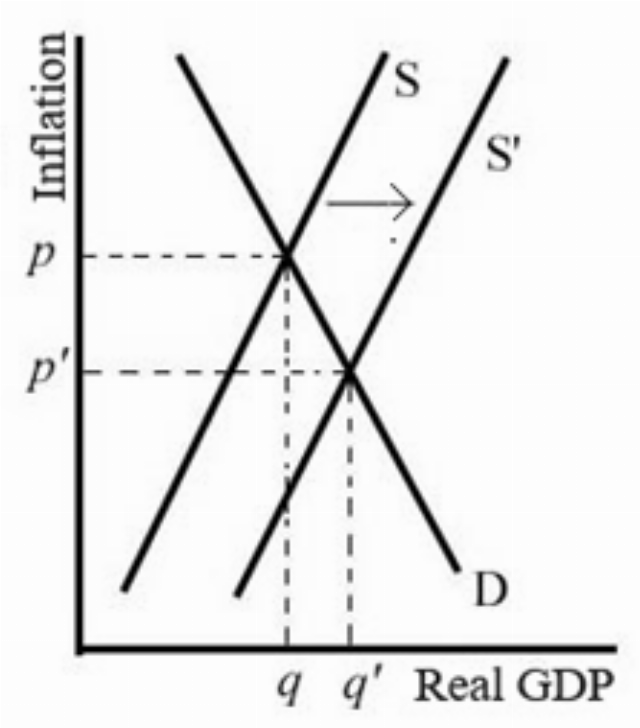

Not all economists oppose Trump’s economic plans, which align with the shifts in economic thinking we have been advocating for nearly two decades. Art Laffer, our country’s premier “supply-side” economist, made clear in a recent interview that Trump’s tax cuts and regulation cuts reduced business costs and produced an economic boom during his first term. When business costs decrease, aggregate supply increases, as shown in the supply-demand graph below. This increases Real GDP from q to q’ while reducing inflation from p to p’:

Top economist Peter Navarro is the author of 20 economics books and one of the architects of Trump’s economic plans. He summarized the current situation in an op-ed in the Washington Times, pointing out that some of our trading partners are playing us as for suckers:

We have lower tariffs and trade barriers than any of our major trading partners. Not coincidentally, we have the highest annual trade deficits.

Each of our trade partners cheats us out of jobs and factories in different ways. For example, Japan uses a dizzying array of nontariff barriers to keep American automobiles and other high-value-added production out of its markets. Germany and other European Union nations gain an unfair advantage with a value-added tax that acts as a de facto tariff on the United States, which relies instead on an income tax.

Our second-largest trading partner, Mexico, is regularly breaking the rules of the North American Free Trade Agreement replacement that former president Donald Trump negotiated but which the Biden-Harris administration does not enforce. Our largest partner, China, breaks every rule in the World Trade Organization book with its “seven deadly mercantilist sins” -- intellectual property theft, export subsidies, currency manipulation, dumping, state-owned enterprises, pollution havens and sweatshops.

Vice President Harris and her running mate have called Trump’s tariffs a “sales tax” and have claimed that they would cause inflation. Peter Navarro addressed this argument, writing:

Here’s the truth: The Trump tariffs did not cause inflation during his presidency. They will not cause inflation in Mr. Trump’s second term.

When America imposes tariffs on major trading partners such as China or Germany, the Trump tariffs force these trading partners to reduce the prices of their goods sold to us. The American market is too important to their export-dependent economies for them to try to pass along the full tariffs to American consumers.

Over time, as the Trump tariffs bring our manufacturing and supply chains back on shore and American corporations invest more in American workers, real wages and employment rise, likewise moderating any possible inflationary effects.

Even if in the short-term Trump’s tariffs would result in higher prices on some products, those higher prices would get U.S. manufacturers to expand their production and many international corporations to build new factories in the United States. Trump’s extremely low 15% corporate tax rate for products made in the United States would encourage this trend. In the meantime, the rest of Trump’s plan, including increased drilling for gas and oil, reduced regulations and reduced business taxes, would tend to lower prices, counteracting price increase caused by tariffs.

The tariffs will also reduce the risk of severe inflation in the future by bringing back American manufacturing. That’s because, given our high trade deficits, the United States must borrow from the rest of the world just to buy imports. Currently we owe 22.5 trillion more dollars to the rest of the world than they owe us. If U.S. external debt triggers a dollar collapse, there will be a huge surge in inflation.

If Trump wins a second term, his common-sense economics would probably cause an even stronger boom than the one which occurred during his first term. The so-called “expert” economists who criticize his plan haven’t yet understood what President Trump, President Reagan, Professor Laffer, and Professor Navarro figured out long ago -- that increasing aggregate supply is the best way to produce a long-term economic boom which brings down inflation.

The Richmans co-authored the 2014 book Balanced Trade published by Lexington Books, and the 2008 book Trading Away Our Future published by Ideal Taxes Association.

Ad Free / Commenting Login

FOLLOW US ON

Recent Articles

- The Danes and the Greenlanders: How They See Trump's America

- The USAID Case: Judge Amir Ali’s $2 Billion Defiance Escalates

- Terrifying Tariffs: Tax Policy as Back-Door Foreign Aid

- Dr. Marty Makary’s ‘Blind Spots’ Book Is At Odds With Established Findings

- Reforming the Kennedy Center

- Is ActBlue a Criminal Enterprise?

- America’s New Tough Love Foreign Policy

- Democrats Stand for Ukraine but Sit for America

- A Friend for Trump in Italy

- Trump’s Digital Fort Knox: Bitcoin, the Dollar, and America’s Financial Future

Blog Posts

- After blowing $9 billion on 'free' health care for illegals, California's Gov. Gavin Newsom asks for a bailout

- Trump throws down the gauntlet to the out-of-control federal district court judges *UPDATED*

- Ronald Reagan also had a slow economic start

- Getting the left out of the political wilderness

- Oregon selects a trans-turtle and a trans-meteor to sit on a ‘mental health advisory board’

- Fly the DEI skies...and hope that you land safely

- This 70-year-old woman is serving 9 years in prison

- Stacey Abrams really, really, wants 'her' $2 billion from Biden's EPA slush fund

- The (un)masked magician’s apprentice

- Schumer’s attempted shutdown will backfire bigly

- The Democrats are so passionate ...

- Biden and the U.S. Steel case

- Jay Bhattacharya's promise on vaccine safety

- MAGA moon over Greenland?

- Trump must designate the Muslim Brotherhood a terrorist organization