Nobel laureates wrong again: Trump would bring down inflation

On June 25, 16 Nobel Prize laureates signed an open letter that held that the election of Trump over Biden would cause inflation to increase. Thirteen of them had previously signed a 2021 letter that predicted that Biden’s Build Back America plan would “ease longer-term inflationary pressures,” even though it ended up contributing to the high inflation rate that has continued throughout Biden’s presidency.

These Nobel laureates share the Democrat party’s commitments to inclusivity and combatting climate change, as indicated by two statements in their newer letter (boldface mine):

- “An additional four years of Joe Biden’s presidency would allow him to continue supporting an inclusive U.S. economic recovery.”

- “In his first four years as President, Joe Biden signed into law major investments in ... climate.”

Even though they argued that a new presidential term for Trump, in contrast to one for Biden, would increase inflation, the opposite is actually true. During the coming term, Congress and the president will have to bring down the U.S. government’s debt-to-GDP ratio as Federal Reserve chair Jerome Powell warned in a February 5 interview:

The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy. ... It's probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.

Conservatives allied with Trump are working on plans to cut government spending by eliminating as many as 50,000 federal jobs to bring down the debt-to-GDP ratio. Meanwhile, Biden (or his Democrat party replacement) would favor tax increases upon the rich to bring down the debt-to-GDP ratio.

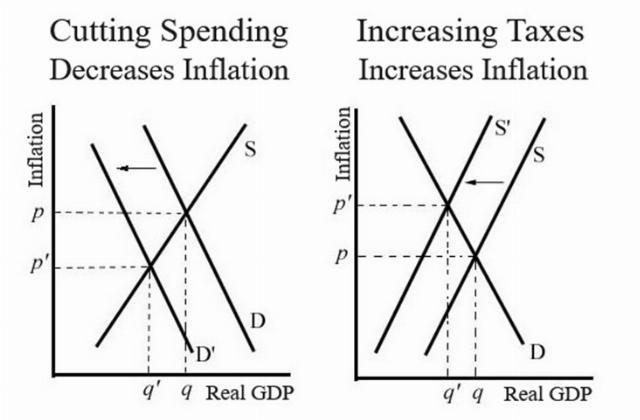

Trump’s spending cuts would reduce the government portion of demand and thereby reduce inflation, as shown in the left-side panel of the following supply-demand graph. Meanwhile, Biden’s (or his Democrat party replacement’s) tax increases would reduce producer incentives and thus supply and thereby increase inflation, as shown in the right-side panel:

Not only would inflation be differently affected, but GDP would also. That’s because spending cuts reduce GDP by far less than do tax increases. Economists have calculated “multipliers” in order to determine the effects upon GDP of changes in taxes and government spending.

- Tax change multiplier. The multiplier for tax changes, found by economist Alexander Ziegenbein and others (including Christina Romer, chair of President Obama’s counsel of economic advisers), was found to be at least 1.6 to 2.07, and even higher for tax increases, meaning that a tax increase subtracts more than twice its total value from GDP.

- Spending change multiplier. The multiplier for spending changes, found by economist Valerie A. Ramey in a large number of historical studies, is almost always less than one. This is partly because government spending often replaces private spending and partly because bigger government is often accompanied by bigger business regulation. As a result, a cut in government spending subtracts less than its total value from GDP.

In other words, Trump’s spending decreases would bring down inflation and greatly improve the debt-to-GDP ratio, whereas the tax increases promoted by Biden (or his Democrat party replacement) would increase inflation and do much less to improve the debt-to-GDP ratio.

Meanwhile additional tax and regulation cuts from Trump would further increase incentives, thereby increasing supply and reducing inflation, whereas new spending increases from Biden (or his Democrat party replacement) would increase demand and thereby increase inflation. The 13 partisan Nobel Prize laureates who signed both this letter and the 2021 letter are wrong yet again!

Howard Richman co-authored the 2014 book Balanced Trade, published by Lexington Books, and the 2008 book Trading Away Our Future, published by Ideal Taxes Association.

Image: Gage Skidmore via Flickr, CC BY-SA 2.0.

FOLLOW US ON

Recent Articles

- Deep Dive: The Signal Chat Leak

- Mark Steyn’s Reversal of Fortune

- Where We Need Musk’s Chainsaw the Most

- Trump Is Not Destroying the Constitution, but Restoring It

- The Midwest Twilight Zone and the Death of Common Sense

- Hijacked Jurisdiction: How District Courts Are Blocking Immigration Enforcement

- Transgender Armageddon: The Zizian Murder Spree

- Jasmine Crockett, Queen of Ghettospeak

- The Racial Content of Advertising

- Why Liberal Judges Have a Lot to Answer For

Blog Posts

- Amid disaster, watch Bangkok clean up and rebuild

- Katherine Maher shoots herself, and NPR, in the foot

- A visit to DOGE

- You just might be a Democrat if ...

- Yahoo Finance writer says Trump’s tariffs will see America driving Cuban-style antique cars

- Kristi Noem and the prison cell

- Dividing the Democrats

- April 2nd: Liberation Day and Reconciliation Day don’t mix

- Red crayons and hospital gowns

- The Paris Climate Agreement was doomed from the start

- Well excuse me, I don't remember

- Bill Maher goes civil

- Mass shootings: we're all survivors!

- Tesla and a second

- Snow White: a bomb for the ages