Federal Reserve price controls will enrich Fortune 500 companies

The Chairman of the Federal Reserve must testify twice per year before Congress to report on federal monetary policy and the overall health of the U.S. economy. This event is on the agenda of every economist, financial analyst, market leader, and professional political analyst, as it provides direct insight into current market conditions, data on inflation, and the short- and medium-term plans the Fed has to maximize the strength of the U.S. economy.

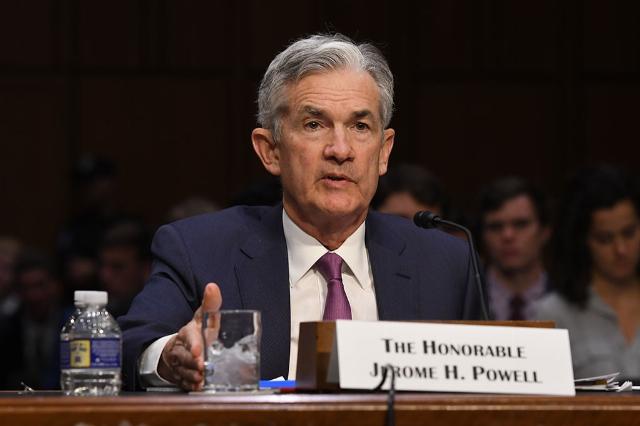

In his testimony to the House and Senate oversight committees, Federal Reserve Chairman Jerome Powell did not disappoint. For nearly three hours, House Members and Senators listened intently to Chairman Powell´s testimony, during which he astonishingly stated that things are getting better for working American families.

But don’t take the Fed chairman’s word at face value. Protecting the working class isn’t a top priority for the central bank. If it was, it wouldn’t be considering a rule that history proves will benefit large corporations at the working class’s expense.

For example, in November of 2023, the Fed published Regulation II, a proposed price control that would further limit the interchange, or “swipe,” fees that banks can charge corporations to process their debit card transactions.

Under current rules, passed in the Dodd-Frank Wall Street Reform legislation in 2010, banks and credit unions are restricted to a 21 cent per transaction fee, plus .05 percent of the total sale. This new proposal would cut that fee by almost 30% to 17 cents per transaction, plus .04 percent of the total sale.

At first blush, this would seem to be an advantage to consumers, but, as they say in mystery novels, “Qui bono?” -- who benefits?

In this case, the beneficiaries will be the large retail merchants like Walmart, Target, and Lowes, and these multinationals are pulling out all the stops to ensure that this rule takes effect. We know this because that’s exactly what happened when Congress passed the first wave of price controls on swipe fees.

Since the restrictions were introduced in 2011, these big-box retailers have reaped huge benefits -- some estimate nearly $100 billion dollars -- with little tangible benefits for the consumer. Prices have not gone down, despite these lower costs, and the beneficiaries add these gains to their bottom line. The real victims are not only the small and mid-sized banks and credit unions but their customers as well, who have borne the cost through higher fees on checking accounts and the elimination of bank-sponsored promotional products. Businesses normally pass higher expenses on to their customers and hardly ever pass expense savings on to their customers.

The Federal Reserve’s Board of Governors knew this at the time. It expressed concern that the rule may unevenly distribute wealth and hurt America’s small financial institutions. Now, however, the Fed is doubling down at the behest of these retail giants, proposing to lower their costs while demanding no rebates to the overburdened consumer.

This rule comes in direct contrast to Chairman Powell´s March remarks. The Fed isn’t in the business of creating fairness; it’s in the business of determining winners and losers in the marketplace, and Regulation II is a clear example of insiders working overtime to enrich one side at the expense of the other.

Thompson served as an adjunct professor of economics with the John Brown University Soderquist College of Business. He is also a retired Air Force colonel who served as a congressional delegate for the Association of Mature American Citizens (AMAC).

Image: Federal Reserve