Yellen Wrong Yet Again!

Treasury secretary Janet Yellen has recommended one foolish policy after another while ignoring their negative long-term effects. Her policies, both as Fed chair and as Treasury secretary, have contributed to inflation and debt. She has proposed an ill conceived capital gains tax that would reduce future economic growth. Furthermore, she argues, incorrectly, that the federal government’s growing debt is sustainable.

Capital Gains

When nominated for her current position, Yellen said that the Treasury Department would look into the possibility of a tax on the unrealized capital gains of billionaires. This option was incorporated into President Biden’s latest budget proposal, but instead of just taxing billionaires, all households that had a wealth of $100 million or more would pay it as part of an alternative minimum tax. If enacted, it would be a disaster.

A tax upon unrealized capital gains would apply to tax-paying households any year when the value of their stocks had gone up, often forcing them to sell stock in order to pay the tax. What would happen to the same households when stock values go back down, as they often do? Would the government pay them back the money that had been taxed? Would the government restore to them the stock that they had had to sell to pay for temporary gains? Of course not! Investors would stay away from risky stocks, which by their nature have both the potential to go up greatly and the potential to go down greatly. The withdrawal of investment funds from risk-takers would slow America’s future economic growth.

The Treasury Department’s other capital gains proposal in the Biden administration’s current budget is just as foolish. It would approximately double the top capital gains tax rate from the current 20% to 39.6%. How would stock investors and entrepreneurs respond? Since capital gains represent the expectation that future profits (and dividends) will rise, stock investors would hold onto stocks whenever possible so as to pay the lower tax rate upon dividends eventually, instead of the higher tax rate upon capital gains now. Meanwhile, entrepreneurs would be heavily taxed whenever they sold one start-up in order to use the proceeds to found another start-up. The resulting harm to entrepreneurship would slow America’s future economic growth.

There is an ideal treatment of capital gains called the “tax-free rollover treatment.” They shouldn’t be taxed when they are immediately re-invested, but should be taxed only when they are consumed. And when consumed, they should be taxed at the same graduated tax level as other income. Meanwhile, dividends should also be taxed at the same graduated tax level as other income, and corporations should be taxed on stock buybacks. This treatment would encourage economic growth.

Yellen’s foolish capital gains tax proposals would have negative long-term effects, similar to the effects of the money supply policy that she put in place during her previous job, when she was chair of the Federal Reserve.

Money Supply

Yellen’s immediate predecessor as chair of the Fed, Ben Bernanke, was a brilliant economist. He greatly expanded the money supply by purchasing long-term bonds and mortgage securities (not just short-term bonds) in a successful attempt to prevent the Great Recession of 2008–2009 from turning into a repeat of the Great Depression of the 1930s. Also, during the worst part of that recession, he helped out America’s trading partners when their currencies began crashing against the dollar, thereby preventing a repeat of the Asian Tiger exchange rate meltdowns of 1997, which, when ignored by then–Fed chair Alan Greenspan, resulted in the artificially high dollar exchange rate that has hurt and continues to hurt American manufacturing.

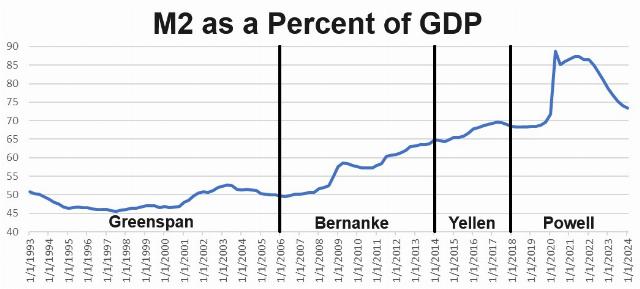

However (as shown by our “M2 as a Percent of GDP,” chart which displays Federal Reserve data), after fixing the Great Recession, Bernanke did not return the money supply to 45–50% of GDP, the percentage maintained by Greenspan, which had kept inflation at bay for decades. Instead, he continued to expand the money supply. This was likely a mistake. When he was replaced by Janet Yellen as Fed chair in February 2014, the money supply stood at 64.9% of GDP.

When Yellen took control of the Federal Reserve, instead of bringing Bernanke’s excessive money supply back down to about 50% of GDP, she continued to increase it. She acted as if she believed the leftist Modern Monetary Theory, which holds that the central bank of a monetarily sovereign country can keep printing money at ever growing levels without causing inflation.

As a result, she left her successor Jerome Powell with a money supply that was 68.4% of GDP. Powell, in turn, continued to raise the money supply to a peak of 88.7% of GDP in April 2020 in an attempt to help the economy during the COVID lockdowns.

Unfortunately, the money supply had reached such a high percentage of GDP when inflation began to take off in April 2021 that Powell could no longer bring it down quickly by reducing money supply growth. In fact, the only tool left in the Fed’s toolbox, given the “ample reserves” that he and his immediate predecessors had created, was the slow-acting tool of setting a rising price floor for short-term interest rates. Now, years later, inflation persists, with inflationary expectations having become ingrained in the American economy. Meanwhile, high interest rates are hurting everyone from first-time home-buyers to the U.S. Treasury.

There is an ideal treatment of money supply called “monetarism,” which was first advocated by Milton Friedman back in 1967. The Federal Reserve can prevent inflationary expectations from rising by keeping the money supply growing at about the same rate that GDP is growing — the successful policy that was later followed by Alan Greenspan when he was Fed chair. If that policy were to be combined with balanced trade and stable government spending levels, consistent economic growth with stable price levels would ensue.

Government Spending Increases

Another reason for our current intractable inflation is the Biden administration’s greatly increased government spending. As soon as Biden took office at the beginning of 2021, his administration, with Yellen participating, pushed through Congress a series of bills that increased federal spending by trillions of dollars. This high level of spending in 2021 (and Trump’s high level of spending in 2020) could, perhaps, be justified by COVID, but Biden’s high level of spending continued in 2022 and 2023, after COVID had been defeated.

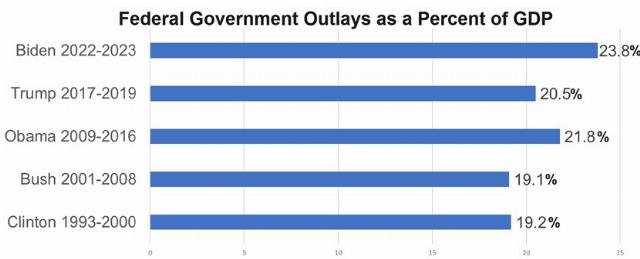

Previous presidents had kept federal government outlays to a level of 19% to 21% of GDP, but the Biden administration’s outlays were 23.8% of GDP during the two years from 2022–2023, as shown by our “Federal Government Outlays as a Percent of GDP” chart (which was built using Congressional Budget Office data).

Currently, the U.S. economy is like a car with its brakes and gas pedal both pushed to the floor. Biden’s hugely increased federal spending is pressing down upon the fiscal policy gas pedal while Powell’s Federal Reserve is pressing on the monetary policy brakes. The result is massive government borrowing at much higher interest rates, which is making managing the federal debt much harder. Federal government interest payments were $517 billion in the last full quarter of the Trump administration in 2020. By the first three months of 2024 they had doubled to $1,059 billion.

Meanwhile, Secretary Yellen seems to largely ignore the long-term disaster that her administration’s excessive spending and borrowing is producing. The federal government’s debt has already grown to an unsustainable 123% of U.S. GDP. Yet, in an interview on May 13, she stated, “We can probably manage and have a fiscally sustainable path with [a] somewhat higher ratio of debt to GDP.”

It is true that Japan has managed to have an even higher debt-to-GDP ratio than the current U.S. rate, but Japan, unlike the U.S., owes its debt almost exclusively to its own people. If Congress doesn’t soon begin to act responsibly, debt payments as a percentage of GDP will continue to grow until a crisis occurs — hyperinflation, a government default, a crashing dollar exchange rate, or some combination of all three.

The solution is obvious. Congress needs to become fiscally responsible, as it occasionally has in the past. A bipartisan agreement needs to be forged that will constrain government spending to a sustainable level of about 20% of GDP. (The alternative solution, increasing taxes, would tend to increase inflation, because higher business costs cause higher prices.)

Yellen’s statements regarding the sustainability of U.S. debt cannot be trusted any more than could her capital gains tax proposals or her excessive monetary growth. Time and time again, she has supported foolish policies while ignoring their negative long-term effects.

The Richmans co-authored the 2014 book Balanced Trade, published by Lexington Books, and the 2008 book Trading Away Our Future, published by Ideal Taxes Association.

Picryl.

" captext="Picryl" src="https://images.americanthinker.com/qj/qjytgfr8ipn8clmgigfw_640.jpg" />

Image via Picryl.

FOLLOW US ON

Recent Articles

- The Death of the Center-Left in America

- ‘Make Peace, You Fools! What Else Can You Do?’

- When Nuclear Regulation Goes Awry

- The Danger of Nothing

- A New Pope With Courage

- Not in Kansas Any More

- Democrats Dying on the Most Desolate Hills

- If She’s an Astronaut … I’m a Jet Fighter Pilot

- Is the Jihadist Trojan Horse Winning?

- Who Has the Best American Autobiography?

Blog Posts

- Celebrate Earth Day by not burning a Tesla

- Minnesota state bureaucrat charged with vandalizing Teslas to the tune of $20,000 is let off scot-free

- Trump’s plan for Gaza vs. the New York Times

- What’s next for Syria?

- Tulsi Gabbard's latest Biden revelation

- Mexican ammo wranglers

- Rep. Jamie 'Maryland Man' Raskin also threatens Trump supporters

- The eight narrative fallacies that drive American politics

- Summertime reality twisted into climate exasperation

- Life discovered on a distant planet?

- The answer is not blowing in the wind

- Letitia James: it's either/or

- Harvard elitism meets Donald Trump

- The GEC is finally more than mostly dead

- We're not the same