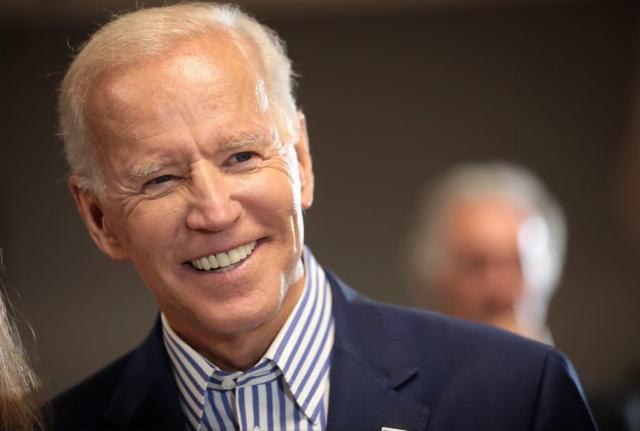

What the Markets Are Saying (about Biden)

After a strong run in 2023 and early 2024, stock markets have been selling off lately. I cannot predict whether this market sell-off will continue, but I can state what has happened so far and speculate as to why it has happened and whether it will continue. In my opinion, anyone who says he can do more than speculate is deceived or lying.

After closing at an all-time high of 5,254 on March 28, the S&P 500, a broad measure of the U.S. stock market, fell to 4,967 (as of April 21). The 5.5% correction corresponds with some troubling inflationary news, and it may (or may not) be only the beginning. Much may depend on whether the April CPI and other inflation numbers confirm what has been happening for the past two or three months.

That latest retail sales numbers, released on April 15, were surprisingly strong at 0.7% month over month, but further thought reveals that most of the increase in retail spending was simply an effort to keep up with rising prices, including higher energy costs and perhaps to pay higher taxes on those wages, and that the higher spending was financed not just with rising wages, but with borrowing as well.

American workers have lost ground against inflation, and they continue to lose ground. Their increased spending is not a sign of a robust economy; it is a mark of desperation. And retirees on fixed incomes are hurt even more: even though their Social Security is adjusted annually, those adjustments do not seem to keep up with actual basic expenses such as food, utilities, insurance costs, and housing.

In late 2023, there was widespread agreement among economists that the Federal Reserve was planning as many as six rate cuts before the end of 2024. That prediction of six cuts was then revised downward to as few as two or three. Now there is fear that the Fed will not cut at all in 2024 and may be forced to raise rates, either in late 2024 or early 2025. Generally speaking, rising interest rates are not good for the stock market because higher bond rates compete with stocks for investment dollars.

None of this is set in stone. Inflation numbers that have been rising and causing a market correction could reverse at any time and result in a market rally. Or other factors, such as a broader war in the Middle East or Chinese invasion of Taiwan, would probably lead to further market declines. No one can predict the short-term movement of the markets because those movements depend on future events that, by definition, are unknown at this time.

But one can prepare for different scenarios and adjust one’s plans accordingly. My opinion is that the market will decline further in the next few months based on the fact that the market was overbought and due for a correction and the fact that global events point toward the possibility of greater conflicts and the fact that inflation numbers have been trending higher. All of these are facts, not speculation, but any or all of them could reverse, and the market could move sharply higher as a result. Again, no one can predict the future of the markets, and I am not offering a prediction.

As I see it, a market correction of 10% to 20% would be healthy for the markets. I believe that market prices are too high, and a normal, healthy correction at this point might prevent a steep decline later on. A normal correction over the next six months might pave the way for further market gains at the end of the year. Or they might not. Again, it’s caveat emptor.

Another fact is that rising interest rates offer an attractive alternative to stocks. The Vanguard Federal Money Market, considered to be a safe, short-term investment mostly in Treasury Bills, currently pays a yield of 5.27%. Even though it is only about one percent above current inflation, that is a good alternative to stocks, which might lose some of their value at any time.

In the words of leading economists, U.S. inflation is proving to be “sticky,” and the underlying reason is persistent over-spending by Congress and the president. Government spending was already much too high under President Trump, but it has been wildly out of control under Biden, and Biden’s latest budget and commentary on the budget show that he plans to continue with the overspending of his first three full years in office, as if those three years of uncontrolled spending represent a new floor for future budgets, not just a temporary response to COVID and other emergencies.

Biden’s overspending is a fact, not speculation, and his plan to continue spending at this wildly irresponsible level is also a fact, documented by his words. It is therefore likely that if Biden is re-elected along with Democrat control of one or both houses of Congress, huge excesses may continue, and inflation might not decline — not without more tightening of the federal funds rate, which now stands at a 23-year high and might (again speculation) rise by another one or two percent or more. Normally, such rate hikes would cool the economy and bring inflation down, but the Fed would be operating in competition with massive and unprecedented government overspending, and so inflation might be at a stalemate.

None of this would be good for investors, even for investors in short-term bonds, which would then return little more than inflation. Nor would it be good for those not directly invested in the stock or bond markets, since their pensions and annuities are also subject to competition with rising rates.

One cannot consistently predict the future of markets or of geo-political events or of the underlying economy, but one can say that we stand at a dangerous crossroads. Biden’s announced plan to continue with even greater levels of overspending is a clear and present danger to almost every American.

This is not speculation — it is fact. I do not pretend to know the future, but I can say with confidence that if Biden is re-elected along with Democrat control of Congress, the next four years will be exceedingly difficult for most Americans.

Jeffrey Folks is the author of many books and articles on American culture, most recently Heartland of the Imagination (2011).

Image: Gage Skidmore via Flickr, CC BY-SA 2.0.

FOLLOW US ON

Recent Articles

- Jay Leno, Dementia, and the Impermanence of Life

- We Must Teach Children to Love Freedom More Than Government

- Judge Not

- A Good Day For The Navy

- Woke Ideology Requires Antisemitism

- Trump and the Public Trust

- Trump’s First 100 Days: A Scorecard of Wins, Waits, and Wobbles

- Larry David: No Longer the Master of his Comedic Domain

- Mass deportations without ICE enforcement

- Harvard’s Tax-Exempt Status and Religion-Based Bequests

Blog Posts

- Forget Trump’s blue suit. What about those so-called ‘transgender’ mourners at the Pope’s funeral?

- About those port explosions in Iran *UPDATED*

- Shedeur Sander’s fall from grace

- There goes the sun?

- Trump’s 'come to Jesus’ moment on Ukraine, at Pope Francis’s funeral

- Reflections on a papal visit

- When the center-fielder saved the flag

- What vote by mail gets you

- A real deterrent for violent criminals

- Recruiting mysteriously, dramatically, increases

- Climate scientists want to shut off the sun

- Drone footage shows Pacific Palisades reservoir still empty

- Biden pops up at the pope's funeral, looking lost

- The mind-numbing, innovation-destroying DEI permeating Washington State government *UPDATED*

- Leftism is killing chocolate