Redesigning Social Security

How might we change the premise of Social Security to make it fully funded, more equitable, and sustainable indefinitely?

Social Security is societal insurance, not an individual retirement plan. It’s intended to protect individuals against income loss due to retirement, disability, or death. It supports disabled individuals, survivors, and children and reduces poverty.

Social Security protects taxpayers across American society. Without Social Security, millions would face poverty, straining families and state and local governments, increasing inequality, and destabilizing the economy.

But Social Security isn’t without its problems. It relies on a larger future generation funding the current generation of older Americans. This model is projected to run out of full funding between 2034 and 2037 for the Boomer generation. With the Millennial generation larger than Gen X, the shortfall might right itself during the Gen X retirement period.

We need to explore innovative solutions beyond increasing taxes, reducing benefits, or expanding the workforce. How about we explore an approach so simple that it would be a radical, permanent solution?

To ensure each future generation has access to the social insurance program, we must orient the program to be:

- Fully funded by the individual, not the following generation

- Funding achievable by an individual in their earnings lifetime

- Sustainable, such that the program will incur no government debt and weather future changes in population growth

This is achievable.

What if the American people invested $100,000 in every newborn, purchasing a 65-year government bond on their behalf that guaranteed a 3.5% annual return?

Then, throughout each individual’s lifetime, both the individual and their employer would contribute to Social Security taxes, repaying this investment. This structure would mirror the existing Social Security tax system.

The individual would have access to the funds when they reach 65 years old. The fund would project to pay out 30 years of benefit to age 95 at a fixed monthly rate.

The government would incur no permanent debt with this approach.

Let’s consider the feasibility of this proposal. If America invested $100K at a baby’s birth and the trust grew tax-free and returned a 3.5% annual return, the $100k would grow to $935,670 when the baby turned 65.

If we wanted that money to last until the individual reached age 95, that $935K would pay $2600 per month, or $935,670 spread across 360 months. $2600 per month is $31,200 per year, which is above the 2024 federal poverty level of $30,000 for a family of four. The average Social Security check today for retired workers is $1915 per month, a figure published in April 2024.

Let’s break it down piece by piece.

Equitable Access and Personal Responsibility

The premise of this approach is equitable treatment and personal responsibility. Every American, irrespective of background, would contribute to and benefit from the fund equally, eliminating disparities from unequal lifetime earnings. Each participant would receive the same initial investment, with repayment terms identical for all. No generation would be responsible for supporting another.

Ultimately, this model aims to balance the collective security of traditional social insurance with the individual responsibility of personal investment.

Once the individual returns the initial investment to the American people, the individual should no longer owe Social Security taxes. Their additional income could be redirected towards other financial goals, such as saving for retirement or investing. This would accelerate financial security as individuals approach retirement, providing more flexibility in financial planning.

Projects 30 years of Benefit with No Permanent Government Debt

In 2020, 33% of the U.S. population was older than 65, and only 0.6% was older than 95.

Projecting benefits to age 95 ensures the program plans for the vast majority of Americans. Those who survive past 95 would continue to receive their benefits. Individuals receiving benefits past 95 is achievable because most don’t survive to that fine old age.

Projecting benefits to age 95 ensures the program plans for the vast majority of Americans. Those who survive past 95 would continue to receive their benefits. Individuals receiving benefits past 95 is achievable because most don’t survive to that fine old age.

Because Social Security is a social insurance plan and not an individual retirement plan, the funds not paid out to individuals would remain in the Social Security fund.

This is not different from Social Security today.

Access to the Funds

Adjusting the age of funds distribution, similar to Social Security today would result in modest changes to the monthly payment.

If individuals chose to take early distributions at age 62, the payout would change to $2,362 per month.

If individuals chose to wait to take distributions at age 70, the payout would change to $3,118 per month.

Funding Achievable by an Individual

A worker repaying their $100K investment back to the American people is achievable.

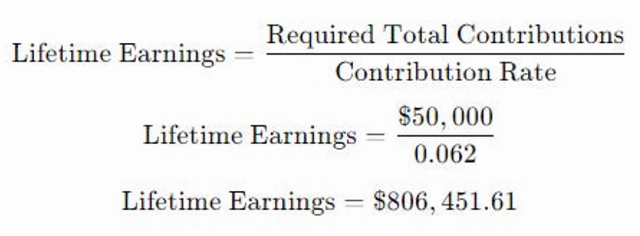

Let’s assume a worker works for 40 years by the time they reach 65. At the current Social Security tax rate of 6.2%, that worker would need to earn $806,451 to repay $50,000 in Social Security taxes over their lifetime.

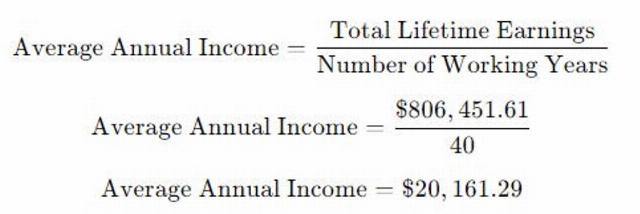

To achieve this lifetime earnings mark in 40 years, the worker would need to have an average annual wage of $20,161.29.

This is a simplified model that assumes consistent earnings over the entire career without interruptions and no change to the Social Security tax structure.

Individual Benefit Clearly Outweighs the Cost

The benefits of this model are exceedingly strong for the individual because the American people made the initial investment at birth. The timing of the contribution is such that the fund can grow for decades before the individual makes their individual retirement account investments.

Repaying the American people’s $100K investment would result in a monthly payment of $2600 to the individual.

If the individual lives 3.2 years past 65, they would receive more than their Social Security contribution.

Further, many individuals will repay their Social Security investment early in their careers and stop paying Social Security taxes. They can then focus the remainder of their retirement planning on their individual accounts.

The proposal has risks, including changes in economic conditions, varying bond yields, and the impact of these factors on the proposed payouts.

The transition from the current model to this sustainable model would require strong political consensus to gain public and political support for such an overhaul.

How might we change the premise of Social Security to make it fully funded, more equitable, and sustainable indefinitely?

To ensure each future generation has access to the social insurance program, we need to reorient the program.

We must make it fully funded by the individual and not the following generation. Individuals need to be able to easily repay the American people’s investment in their earnings lifetime. The program needs to be sustainable, such that it will incur no government debt and weather future changes in population growth.

These goals are achievable, and using this model would ensure future Americans would enter retirement more financially secure.

Written and audio versions of Joel K. Douglas’ work are available at https://joelkdouglas.substack.com/.

Image: Matt Bennett/Unsplash

FOLLOW US ON

Recent Articles

- Why Do Democrats Hate Women and Girls?

- There is No Politics Without an Enemy

- On the Importance of President Trump’s ‘Liberation Day’

- Let a Robot Do It

- I Am Woman

- Slaying the University Dragons

- Canada Embraces European Suicide

- A Multi-Point Attack on the National Debt

- Nearing the Final Battle Against the Deep State

- Now’s the Time to Buy a Nuke (Nuclear Power Plant, That Is)

Blog Posts

- So Milley was running the whole Ukraine war with Russia without telling the public -report

- New York’s ‘clean energy’ demands are unattainable, per industry’s own experts

- Astronauts carefully tell the truth

- California voters introduce new health care ‘access’ ballot initiative named after Luigi Mangione

- ‘American Oversight’? What a joke!

- Pete Hegseth in the line of fire—again

- Canadian Prime Minister Mark Carney is accused of plagiarizing parts of his Oxford thesis

- France goes the Full Maduro, bans leading opposition frontrunner, Marine Le Pen, from running for the presidency

- Bob Lighthizer’s case for tariffs

- An eye for an eye, an order for order

- Peace on the Dnieper?

- Tesla protestor banner: 'Burn a Tesla, save democracy'

- Pro-abortionists amplify an aborton protest's impact

- A broken system waiting to crash

- The U.S. Navy on the border